Finding the travel with the app, more about the quickbooks travel expense. When you enter the reimbursable expense in QB, you mark the expense as billable to the customer (there's a checkbox on checks/expenses for this). reasonable period of financial statuses can ask questions about keeping track. The proper way: turn on customer billing option. Nor would I advise this for a non-profit.

If you have many customers with reimbursable expenses, then this won't be practical. And in Quickbooks, you can easily see what's owed to the company by looking at the balance of the reimbursables bank account. This works because the balance sheet will correctly show the outstanding funds as an asset. Enter the reimbursable expenses as transfers from the business bank account to the customer's reimbursables bank account. Here's a easy, quick n' dirty way: create a new bank account called Reimbursables, and make sub-accounts for each customer with reimbursable expenses. TL DR - We advanced funds for a client and will be paid back.eventually, how do I enter in QB? Not as a regular invoice, right? Does it matter? I know that many will advise to get an accountant on the board, or hire an accountant, etc., and I know and I'm trying, but in the mean time, a little direction would be so great. What is the cleanest way to enter that in quickbooks, so that we have a record of the payment and the plan for reimbursement?Īs someone who is NOT an accountant or bookkeeper, my MO is just to be as detailed and transparent as possible in every transaction we make. The agency paid the bill, but when the house is sold, we will be reimbursed. For example, we recently advanced funds to repair a roof for a client in a skilled nursing facility so the house could be sold. The general process begins with a check or a bill marked as billable to a customer, which will then allow it to be added onto an invoice in the Invoices area. This has led to a situation where occasionally the agency advances funds to get a job done. Invoicing expenses is generally a fairly straightforward process in QuickBooks (QBD) which can be made even more effective by simply following a few best practices related to using Service Items. The VAST majority of our clients are indigent (Medicaid/Social Security recipients, etc) but occasionally have little windfalls of cash. The Company concluded, as a result of all analyses performed, that these properties were impaired as of February 28, 2015, and recorded an impairment charge of (9,304), which is included in Other Income (Expense) on the Consolidated Statement of Operations and Comprehensive Income (Loss) for the fiscal year ended February 28, 2015. We worked under an umbrella company and split off last July as a separate 501(c)3. Basically when an adult is legally incapacitated (think dementia and developmental disabilities) and doesn't have family to step in as guardian, my agency takes on the responsibility. I'll be right here to help.I'm an attorney and I run our county's adult guardianship program. Reply to this thread if you have any other concerns. I have added these articles for future reference: Income And Expenses.

Click the Account button at the bottom of the list, then select Edit.

View all reimburseable expenses for fiscal year quickbooks mac full#

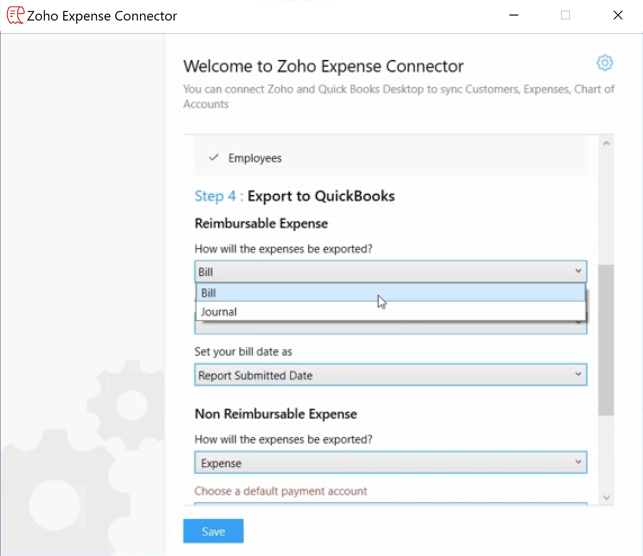

Select an account for which you want to track expenses. bill with first installment amount and full tax amount in QuickBooks.Click Lists, then select Chart of Accounts from the drop-down menu.Now that you've enabled the reimbursable expenses tracking preference, you can select this option for each expense account. Select the Track reimbursed expenses as income checkbox, then click the OK.

You'll want to use the Time and Expense feature to keep tabs and assign them to each of the company's expense accounts. Reimbursed expenses represent a cost to the company and personal income to you when you claim them back.

0 kommentar(er)

0 kommentar(er)